Tax Season Tips: Using Time Tracking to Simplify Section 174 R&D Credit Filing

The R&D Tax Credit Hack You May Be Overlooking

Over the past few years, the landscape around Section 174 of the Internal Revenue Code has shifted significantly. The IRS’s updated guidance, along with the Tax Cuts and Jobs Act (TCJA), now requires businesses to capitalize and amortize R&D expenses—regardless of whether they claim the R&D tax credit under Section 41.

This change has increased the burden on companies (and their advisors) to document and defend R&D-related costs. Unfortunately, many organizations struggle to connect payroll data—especially employee time and effort—to qualified research activities in a way that stands up to IRS scrutiny.

That’s where time tracking comes in. By linking real-time employee activity to R&D projects, businesses can streamline documentation, reduce audit risk, and make it significantly easier to support their R&D credit filings. This blog explains how.

Why Time Tracking Matters for Section 174

Section 174 requires that any costs related to R&D—wages, supplies, software, and even contractor expenses—be capitalized and amortized over five years (15 years for foreign R&D). This includes direct labor: the time employees spend developing new products, processes, or software.

However, the IRS expects companies to demonstrate a clear connection between the work being done and its classification as qualified research. Vague job titles or generic timesheets won't cut it. You need real documentation showing who did what, when, and for which project.

Without that, businesses risk underreporting eligible expenses, missing out on tax savings—or worse, facing penalties if an audit reveals unsupported claims.

How Time Tracking Solves the Problem

Often the most complex challenge for R&D credit claims is properly documenting the labor costs. Ideally you want to be able to accurately allocate your labor costs to the work performed. That way you will be able to easily determine how much the work performed cost the business.

Time tracking is the key to properly allocating labor costs. With time tracking your employees report the amount of time they spend on different projects and tasks. This information can then be used to properly allocate costs.

Dapt automates this by linking payroll results to time tracking information to create detailed accounting entries. These entries are specific to the work performed. All that is required to determine the R&D costs is to total the credits that qualify as R&D.

When facing an audit all that is required is to provide documentation of the purpose of projects and tasks that qualify as R&D. Since the labor allocation is based upon time tracked to these projects and tasks and the allocation is based on the time tracking the accounting entries themselves are the proof of qualification or R&D credits.

The benefits of this approach are many:

- 👉 Accurate cost allocation to qualified research activities

- 👉 Simplified substantiation when preparing Section 174 and 41 documentation

- 👉 Audit-ready records with timestamps, descriptions, and attribution to specific projects

- 👉 Clear differentiation between R&D and non-R&D tasks, even for salaried employees

Example:

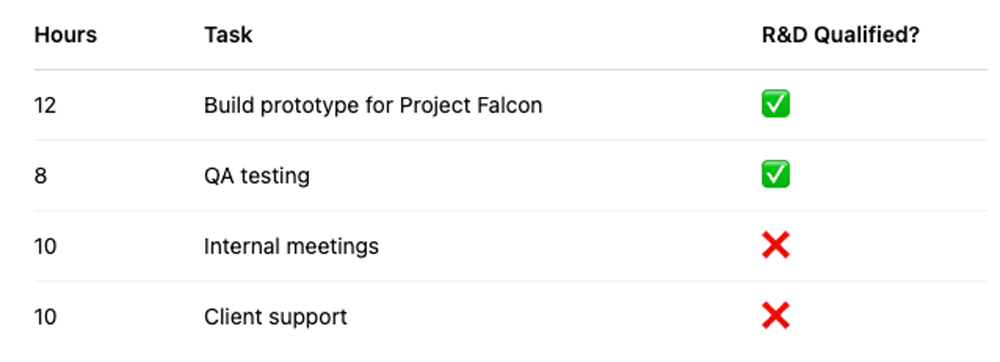

Instead of a generic 40-hour entry for “engineering,” an employee logs:

- 12 hours: Building prototype for Project Falcon (R&D qualified)

- 8 hours: QA testing (R&D qualified)

- 10 hours: Internal team meetings (non-R&D)

- 10 hours: Client support (non-R&D)

Now you can precisely allocate labor costs—and defend them with confidence.

Best Practices for Connecting Time to R&D

The best practice is to create accounting entries that allocate labor costs to R&D or to a specific project that meets the definition of R&D work. If creating these entries is systematic and automatic the result is easy to audit and ultimately defend.

Filing for credits becomes much easier as well. All that is required is to pull the accounting entries that are allocated to R&D. The total of the entries is the amount that qualifies for R&D credit.

To create these accounting entries requires detailed information on the work performed by employees. That is the critical role that time tracking performs. By recording work performed throughout each pay period labor costs can be properly allocated to projects and work performed (tasks). Dapt automates this creation of labor cost entries in accounting. All that is necessary is to implement the best practices in time tracking:

- Use project-based time tracking tools

Look for software that lets employees log hours by task, project, and activity type. - Define qualified research activities clearly

Align your project and task structure with IRS definitions of QRAs—design, development, testing, etc. - Train your team

Educate employees on what qualifies as R&D, and how to tag time accordingly. - Conduct regular reviews

Monthly or quarterly reviews can catch miscategorized time before it becomes a year-end headache. - Map to both Section 174 and Section 41

While 174 and 41 aren’t identical, consistent time tracking supports both.

Strategic Value for Accountants and Advisors

For accounting firms and financial advisors, this is a golden opportunity to deliver more strategic value.

Helping clients implement solid time tracking for R&D not only strengthens their tax position—it gives you cleaner data, faster filings, and higher confidence in the final numbers.

Plus, with more visibility into labor distribution, you can identify underutilized credits and better support contractor allocations, especially when dealing with blended or fixed-rate contracts.

Conclusion: Start Now, Save Later

The next R&D filing season will be here before you know it. Don’t wait until year-end to try to piece together who did what, when, and for which project.

By connecting time tracking to R&D activities now, you’ll simplify your Section 174 filing, strengthen your documentation, and unlock better tax outcomes—for both you and your clients.

Dapt makes it easy.

We automate the connection between payroll and time tracking, creating audit-ready entries that show exactly who did what, when, and why it qualifies.

Want to learn more about this? ADP is hosting a webinar that covers this and more.

At this event, You'll learn how to:

- Identify qualifying activities and costs for R&D.

- Analyze how flow-through entities & corporations utilize R&D credits.

- Examine significant changes to the finalized version of Form 6765.

- Discuss the preliminary draft instructions related to Form 6765.

- Review legislative updates for R&D expensing vs. Section 174 amortization.

Click the image or this link to register for this event.

.png)